There are different motivations for the interest in hydrogen in the energy sector these days – it is being looked at as a resource for storage, generation, industrial processes, and transportation.

While many of the technical applications are in the nascent stage, and the costs are not yet competitive, the resource is poised to take off. The hydrogen market is projected to grow both globally and domestically. The Department of Energy is predicting that by 2050, hydrogen could be a $750 billion per year market with 3.4 million jobs, and the National Renewable Energy Laboratory is projecting a two to four times increase in hydrogen demand in the U.S. by 2050 - roughly 1%-14% of U.S. energy demand.

To help public power utilities understand the potential – and the limitations – of hydrogen, and why they should get involved, we developed Understanding Hydrogen: Trends and Use Cases. This post summarizes highlights from the report and defines common terms associated with hydrogen.

The hydrogen rainbow

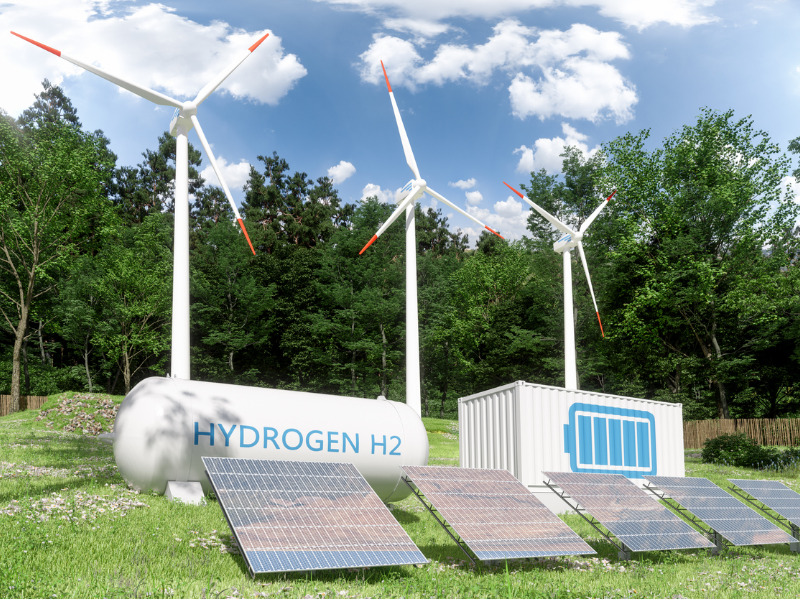

Those reading about hydrogen have probably noticed that there are many colors associated with hydrogen, which tie back to how the hydrogen is produced. Green hydrogen, which is often what is being discussed in terms of research and development today, is also referred to as renewable hydrogen and is produced from renewable sources via electrolysis.

Using hydrogen is not an entirely new concept or technology – but the production and use of green hydrogen is. Currently, most hydrogen production in the United States is from steam methane reforming with fossil fuels – where methane reacts with high-pressure steam to produce carbon dioxide, carbon monoxide, and hydrogen. Although there aren’t universally accepted definitions of the colors of hydrogen, these methods would typically be classified as gray or brown hydrogen. Other colors include pink hydrogen, which is made from electrolysis using nuclear power, and blue hydrogen, which is made from natural gas coupled with carbon capture.

Motivators

Decarbonization is the main motivator for the growing interest in green hydrogen. Many stakeholders are interested in finding low- to no-carbon solutions for the future energy system, and green hydrogen is viewed as a fuel that has the potential to decarbonize both the transportation and the electric sectors.

Green hydrogen is produced via electrolysis – a process of using electricity to split water into oxygen and hydrogen. In the past five years, the costs for electrolysis came down about 40%. Projections for when green hydrogen will become cost-competitive vary and depend on other factors such as policy support and whether and how fast costs for renewable energy and electrolyzers continue to decline. In general, most projections estimate reaching cost competitiveness within the 2030 to 2050 timeframe. If kept in the federal 2022 budget, DOE would soon launch an effort to bring down the cost of green hydrogen production – with a goal of reaching $1 per kilogram of hydrogen by 2032.

Both in the United States and across the world, a lot of the focus on hydrogen is for clean vehicle initiatives. This is in part because hydrogen fuel cells are seen by some as a more viable option for allowing longer range for medium and heavy-duty vehicles than battery electric vehicles. A 2019 report from the International Energy Agency found at least 50 targets, policies, or mandates that support hydrogen globally, and more than 40 of these policies are related to the transportation sector, in particular developing hydrogen fuel cell electric vehicles. In the United States, a series of announcements from DOE, which has an initiative called H2@Scale, have focused on hydrogen, including up to $100 million over the next five years to support fuel cell development and electrolyzers for hydrogen production at the state level.

A major area of interest for utilities around hydrogen is storage. There are not currently long-term seasonal storage options available, and hydrogen, which can be stored in various forms with potentially low operating costs, could be a solution. More research and development, and some demonstration projects, are exploring the cost and feasibility of using hydrogen storage in tandem with intermittent energy resources.

This combination of reasons is why earlier this year, APPA members passed a resolution that supports policies to increase research and development of hydrogen.

Hydrogen and public power

Public power is using hydrogen for their own operations, whether that be generation or storage, and are involved in the hydrogen value chain by helping partners in producing hydrogen for use in other sectors.

Some specific examples of how public power utilities are dipping their toes into this emerging technology include:

- Douglas County Public Utility District in Washington will be using a 5-megawatt electrolyzer, powered by excess hydropower that they have in their community, to produce green hydrogen that will serve a fueling station. The project received a $1.9 million grant from the Centralia Coal Transition Board, plus a $125,000 grant from our Demonstration of Energy and Efficiency Developments (DEED) program.

- The Intermountain Power Agency in Utah is reconfiguring the Intermountain Power Project, including retiring two coal units and deploying 840 MW of natural gas with a 30% green hydrogen fuel mix at startup when it comes online by 2025, and a plan to transition to 100% green hydrogen by 2045. Other public power utilities in California and Utah are involved in the project as well, including the Los Angeles Department of Water and Power. Directly adjacent to the units is the Advanced Clean Energy Storage project, which will use salt caverns for long-duration seasonal hydrogen storage paired with other types of storage.

- The Nebraska Public Power District is testing gasification systems for hydrogen production at a hybrid coal and biomass plant, thanks to a $9.4 million grant from the Department of Energy.

- The Northern California Power Agency received a DEED grant of $48,500 to research the feasibility of developing a green hydrogen production facility near an existing natural gas plant.

- In Florida, the Orlando Utilities Commission received a $4 million grant from DOE for hydrogen production and utilization - including storage tanks, a 510 kw electrolyzer, fuel cells, a transformer, and fuel cell electric vehicles.

Challenges

Similar to other new technologies, economics are a challenge for many of the new applications of hydrogen to be cost-competitive. For wide-scale generation with hydrogen as a fuel source, we're going to want to see decreases in the costs for the electrolyzers and the fuels used to produce hydrogen, and other associated technologies. For practical transport and storage, additional research and development is needed to achieve viable ways to store and transport higher levels of hydrogen. While some current natural gas and other infrastructure can be used to move hydrogen, upgrades would be necessary, and we don't have a robust hydrogen infrastructure network right now. On the storage side, there are geographical limitations on one of the viable ways to store hydrogen, with salt caverns, and some of the other storage options are currently cost-prohibitive.

What to watch

- Lessons learned from demonstration projects and research and development findings

- Complementary trends such as increasing interest in decarbonization, renewable energy, and energy storage

- Decreasing costs of electrolyzers and renewable energy

- Emergence of hydrogen-specific policies

Members can download the report at https://www.publicpower.org/resource/understanding-hydrogen-trends-and-use-cases