In the face of burgeoning demand, whether from data center growth, electrification, or increasing population, public power utilities are focused on building new infrastructure. Projects range from replacing aging power plants to adding renewable energy to meet clean energy goals and building new transmission lines.

A survey of American Public Power Association members found that dozens of public power utilities are developing projects, including early-stage partnerships in small modular nuclear reactors, natural gas plant upgrades, and new geothermal plants, many in the 20-megawatt to 100-MW range, according to comments filed with the Department of Energy. Larger public utilities have plans that could add gigawatts to their systems. The comments were in response to the DOE’s Speed to Power initiative, which aims to accelerate large-scale grid infrastructure projects.

But projects are sometimes slowed or canceled because of supply chain constraints, permitting delays, tariffs, community opposition, and an uncertain regulatory environment.

To help move projects forward, public power utilities are focusing on being ready to respond to interconnection delays, changing market conditions, and other curveballs as they crop up. The utilities learning to be nimble — such as adjusting to tariff pause opportunities to buy batteries sooner to reduce pricing impacts. And they’re engaging with their communities to build understanding of the need for and potential benefits of new projects.

Consistent Uncertainty

In California, Glendale Water & Power is in a power-supply crunch as it seeks to replace aging generation and increase its clean energy portfolio. GWP’s primary power resources are imported renewable and thermal generation with local generation used to meet peak load and ensure reliability. The public power utility decided to retire the majority of its older natural gas-fired generating units at the Grayson Power Plant, GWP’s only local generation resource, because they would no longer be able to economically comply with air emissions rules past 2023. To replace the obsolete generators, which came online in the 1950s-1970s, GWP chose to repower with 75 MW/300 megawatt-hours of battery storage and 56 MW of combustion engines. The utility has only 47 MW of local generation while the project is being built, said Scott Mellon, the utility’s general manager.

The pressure is on to build the Grayson Repowering Project as soon as possible, but that’s not so easy. Challenges included public opposition, extended supply chain delays, tariffs, and cost increases. In addition, data centers are willing to pay higher prices to speed equipment delivery, which raises prices across the market, Mellon said.

GWP is focusing on being as flexible as possible to move the project along, switching gears and reshuffling plans when needed. Planning ahead has been critical, too.

“We had to be very aggressive in our purchasing and identifying the hardware that we needed as early as possible,” Mellon said. “Some of the lead times are 1.5 years to two years. We had to rework the plant arrangement to work around significant delays in delivery of some major equipment,” he said.

When the Trump administration issued a 90-day pause on tariffs with China, GWP and its EPC contractor were able to take advantage of earlier production slots that became available when other buyers canceled their projects due to the imposition of tariffs. As a result, the utility received the batteries four months early at the cost of working out an on-site storage scheme and accelerating the remaining uncompleted foundations. This helped avoid the higher tariffs that would have been levied after the pause if GWP had stayed with the original delivery schedule.

“We had an opportunity to move. Luckily, we were more agile than a municipal utility usually can be,” Mellon said.

“Going into this knowing that structurally, this wasn’t a normal project, we couldn’t look at it with a normal methodology. We had to have some flexibility because there was a consistent level of unknown that we knew we were working with,” Mellon said.

Prioritizing Buy-In

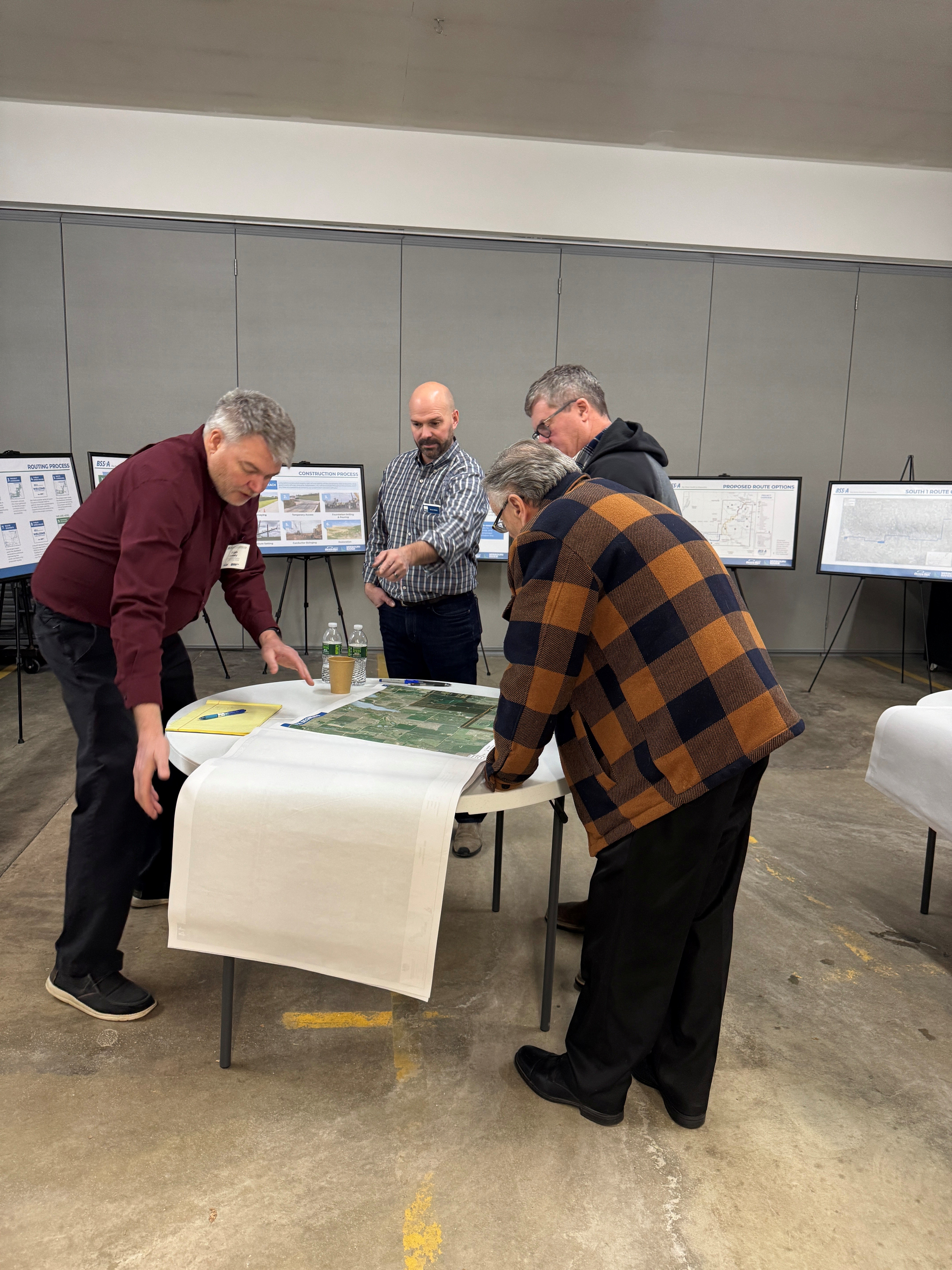

Missouri River Energy Services is focusing on engaging the communities along the route about its plans to build the Big Stone South to Alexandria transmission project (connecting South Dakota and Minnesota), which it is developing with Otter Tail Power Company. Community engagement is also a key goal of its effort to construct a 145-MW natural gas plant near Toronto, South Dakota.

The transmission project includes a new right-of-way, and landowners are concerned that the transmission corridor may affect their use of their property. “There’s a lot of sensitivity from irrigation folks who are concerned about how it will affect irrigation,” said Terry Wolf, vice president and chief operating officer at MRES.

To address these concerns, the utilities held three rounds of open houses before they filed an application for the permit for a 100-mile route, he said. During the meetings, the transmission owners explained that the transmission line is needed to provide reliability and to help meet Minnesota’s ambitious clean energy targets, as it will help transport renewable energy.

Stone South to Alexandria project

“We said, ‘Here are the corridors we’re considering,’ at the meetings, and in response to feedback, we kept refining the route,” he said.

MRES has been working on the project for three years — since it gained approval from the Midcontinent Independent System Operator — in part because it wanted to do as much community outreach as possible early on.

“We’re trying to do things on the front end to avoid landowner complaints on the back end,” Wolf said. “To the extent that we can squeeze landowner outreach in the front end, we make the process more efficient.” Such early planning could cut the project timeline in half, he added.

The transmission line will run through a corridor where a transmission project was opposed in the 1970s. Back then, farmers tore down the project’s lattice structures with their tractors. MRES and Otter Tail Power are also focused on assembling the right engineering and design team to execute the project efficiently.

For its proposed natural gas and diesel plant near Toronto, MRES is focusing on communicating to the local community the need for reliability. During the region’s cold winters, utility customers can’t rely solely on the area’s wind resources, which provide a significant amount of power.

“If the wind calms down, we’ve got to have some other kinds of backup fuel, or people could die,” Wolf said.

For the Toronto generation project, landowner concerns are also the biggest challenge. The project includes a relatively short 4-mile transmission line. MRES also has been communicating to ensure that residents understand the project is not related to a proposed data center that’s sparking concerns.

A second challenge to power plant development is uncertainty about whether MRES will have to pay for infrastructure upgrades to interconnect with MISO. Preliminary studies suggest that no upgrade will be needed.

MRES is working to cut costs by procuring materials — especially transformers, which can have a three-year lead time — as early as possible to avoid cost increases. Finding affordable contractors is also an issue.

Risk is inherent in this type of project, Wolf said. “Interconnection costs could come in higher than expected, a permit denial from the state or county could stop construction. Material delays and costs are an issue, like any large construction project.”

Pathways to Change

For Freeport Electric in New York state, a main challenge has been navigating uncertainty about grant funding through the DOE, said Eric Rosmarin, superintendent of electric utilities.

The utility is looking at ways to incorporate the state’s Climate Leadership and Community Protection Act into its infrastructure and grid. The act calls for 70% zero-carbon electricity by 2030 and 100% by 2040. Freeport Electric applied to the DOE for a $200,000 technical assistance grant for that project.

“I’m hearing from other utilities that even though they’ve had awards from the federal government, they’re not even sure if they’re getting the money now,” he said.

Supply chain delays have also been a challenge for Freeport, but they were worse during the COVID-19 pandemic, when the utility was focused on infrastructure projects and experienced delays with materials and contractors. Right now, obtaining transformers is the biggest supply chain issue, Rosmarin said.

Also of interest to Freeport Electric is energy storage. Because peak prices can be high, the utility wants to charge batteries at night, when prices are lower, and then discharge the batteries when prices are high. Freeport isn’t ready to order batteries, so Rosmarin isn’t sure how tariffs on batteries from China will affect acquisition.

Like Freeport Electric, many public power utilities are trying to add more renewable energy into their mix to meet city or state goals. Many are also looking at transmission and generation projects to meet growing demand. Wolf and Mellon offered a few words of advice for public power utilities in that situation.

“Get the team built that will develop the project — your engineering, legal, and consultants — and make sure land rights are established to help avoid the traditional pitfalls. And you need a supportive board to understand and inform people early and often,” Wolf said.

Mellon also pointed to the need to form a team.

“Find an [engineering, procurement, and construction] contractor who has some experience. Understand that you are working together to get something accomplished — it’s not them versus us, it’s not them and me, it’s us together,” he said.

Reshaping Policy to Help

Meanwhile, APPA is working on the policy front to help its members speed up project deployment.

Latif Nurani, senior regulatory counsel at APPA, said an advocacy priority is to reform the permitting process for infrastructure projects, including streamlining the National Environmental Policy Act to speed federal permits while maintaining appropriate environmental oversight.

APPA’s goals for speeding permitting include a request for Congress to change permitting to give public power utilities the certainty they need to invest in generation, transmission, and distribution infrastructure. In addition, public power advocates are requesting that federal policymakers digitize permitting and establish an interagency sharing portal that allows information to be shared with all federal agencies simultaneously.

APPA also asked the DOE to ensure public power utilities receive financial and technical help. APPA called for the DOE to enable groups of utilities to jointly build generation and transmission projects and apply for grants as a single organization, such as through JAAs. And APPA called for the DOE to help boost certainty by streamlining applications for technical and financial assistance.

“A ‘one-stop shop’ — describing the range of programs available and eligibility requirements — would allow for more utilities to make use of the programs. Furthermore, greater certainty around the durability of assistance programs will allow beneficiaries to more effectively plan and execute on projects that expand grid capability,” APPA said.

APPA’s comments also suggest that the DOE could analyze proposed Environmental Protection Agency rules to identify whether they’ll affect reliability or resource adequacy.